Things about Financial Advisor License

Wiki Article

Financial Advisor Jobs Fundamentals Explained

Table of ContentsA Biased View of Advisors Financial Asheboro NcThe Financial Advisor License StatementsWhat Does Advisors Financial Asheboro Nc Do?Financial Advisor Jobs - Questions

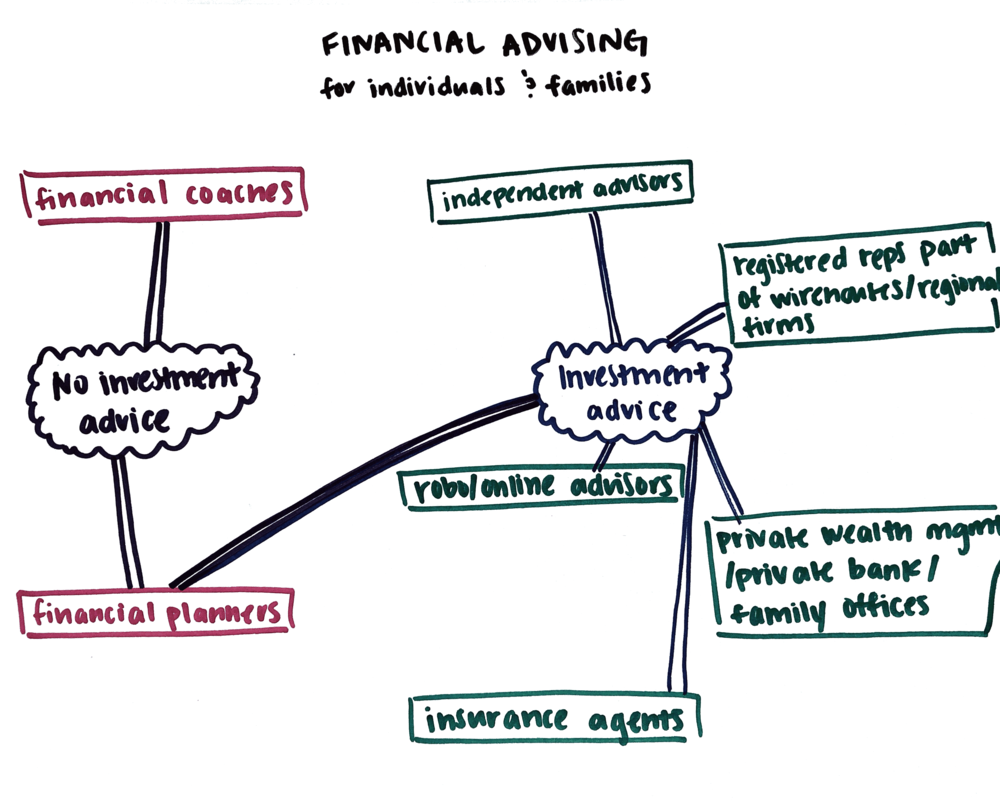

There are numerous kinds of monetary experts available, each with varying credentials, specialties, as well as levels of responsibility. And when you're on the hunt for an expert suited to your demands, it's not uncommon to ask, "How do I recognize which economic consultant is best for me?" The answer begins with an honest accountancy of your requirements as well as a little bit of study.Types of Financial Advisors to Consider Depending on your monetary needs, you may opt for a generalised or specialized monetary expert. As you start to dive right into the globe of seeking out a financial expert that fits your needs, you will likely be presented with lots of titles leaving you asking yourself if you are calling the ideal individual.

It is essential to keep in mind that some monetary experts also have broker licenses (definition they can sell protections), but they are not exclusively brokers. On the same note, brokers are not all certified just as and also are not monetary advisors. This is just among the many reasons it is best to begin with a certified financial planner that can suggest you on your investments as well as retired life.

Advisor Financial Services Fundamentals Explained

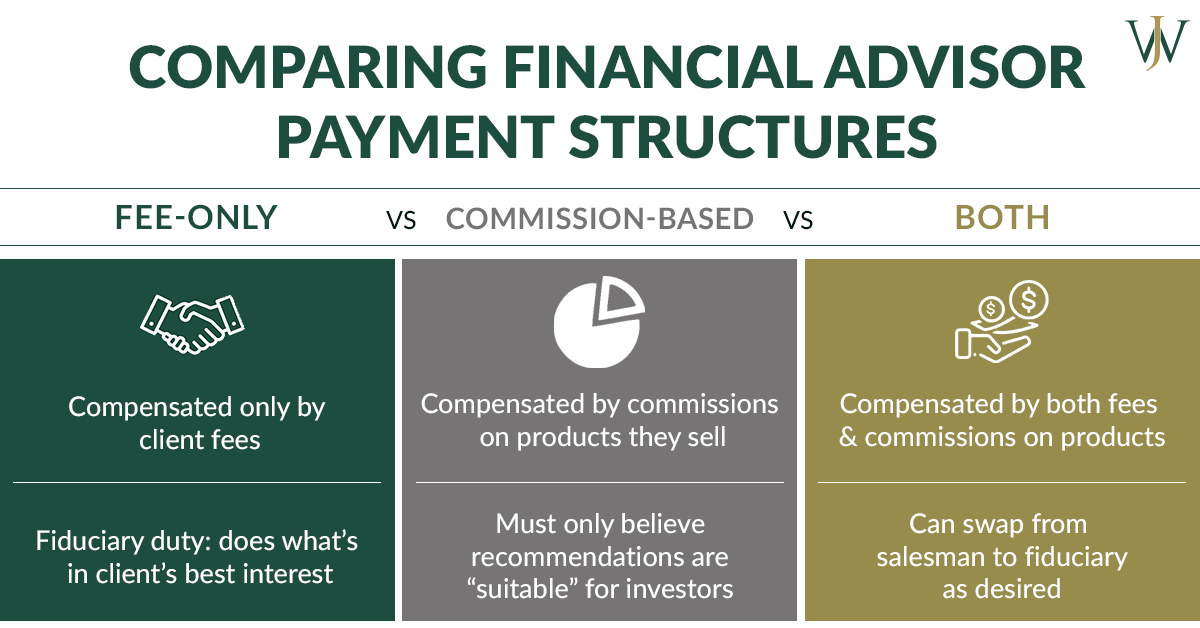

Unlike financial investment consultants, brokers are not paid straight by customers, rather, they earn compensations for trading supplies and also bonds, as well as for offering mutual funds as well as other items.

You can usually inform a consultant's specialized from his or her financial certifications. For example, a certified estate coordinator (AEP) is a consultant that focuses on estate planning. When you're looking for an economic advisor, it's great to have a concept what you want help with. It's also worth mentioning economic organizers. financial advisor near me.

Much like "monetary consultant," "financial organizer" is likewise a wide term. Regardless of your particular demands and also monetary circumstance, one requirements you should strongly take into consideration is whether a possible consultant is a fiduciary.

The Buzz on Financial Advisor

To protect financial advisor duties yourself from someone who is merely trying to get even more cash from you, it's a good suggestion to look for an advisor that is signed up as a fiduciary. A financial advisor who is signed up as a fiduciary is called for, by regulation, to act in the very best passions of a customer.Fiduciaries can only suggest you to use such products if they think it's in fact the very best monetary choice for you to do so. The U.S. Securities and also Exchange Payment (SEC) manages fiduciaries. Fiduciaries that fall short to act in a customer's benefits could be struck with penalties and/or jail time of approximately ten years.

That isn't since any person can obtain them. Getting either qualification needs somebody to go with a variety of classes as well as examinations, along with gaining a set quantity of hands-on experience. The outcome of the qualification procedure is that CFPs as well as Ch, FCs are skilled in topics throughout the area of personal financing.

For instance, the charge can be 1. 5% for AUM between $0 and $1 million, yet 1% for all possessions over $1 million. Fees usually reduce as AUM boosts. An expert that generates income entirely from this administration cost is a fee-only advisor. The alternative is a fee-based advisor. They sound comparable, yet there's an essential difference.

Advisors Financial Asheboro Nc for Beginners

An expert's monitoring fee might or might not cover the costs associated with trading securities. Some consultants also charge a set charge per purchase.

This is a service where the expert will certainly bundle all account management costs, consisting of trading fees as well as expenditure proportions, right into one extensive cost. Because this fee covers much more, it is normally more than a charge that only consists of monitoring as well as excludes points like trading prices. Cover costs are appealing for their simpleness yet additionally aren't worth the expense for everybody.

While a conventional advisor generally bills a charge between 1% and 2% of AUM, the fee for a robo-advisor is usually 0. The huge trade-off with this link a robo-advisor is that you usually don't have the capability to speak with a human consultant.

Report this wiki page